Introduction: Southern California's Real Estate Powerhouse

Southern California's real estate market stands as one of the most dynamic and closely watched housing markets in the nation. Anchored by a diverse economy spanning technology, entertainment, healthcare, and international trade, the region continues to attract buyers from across the globe despite persistent affordability challenges.

Within this landscape, Orange County emerges as a pivotal market that commands particular attention. Positioned between the sprawling urban core of Los Angeles and the affluent coastal enclaves of San Diego, Orange County represents a unique convergence of lifestyle, economic opportunity, and aspirational living. With a median home price exceeding $1.3 million and a population approaching 3.2 million residents, the county delivers masterfully planned communities, award-winning school districts, and unparalleled access to both Pacific coastline and major employment hubs.

Orange County matters because it serves as both a bellwether for California's broader housing trends and a distinct market unto itself. Cities like Irvine attract tech professionals and international investors with master-planned perfection, while coastal communities like Huntington Beach and Newport Beach command premium valuations for their beachfront lifestyle. Inland cities such as Fullerton and Anaheim offer relative affordability—though "affordable" remains a subjective term in a county where entry-level homes routinely exceed seven figures.

As we transition into 2026, understanding Orange County's trajectory requires analyzing not just local market dynamics but the broader macroeconomic forces, demographic shifts, and policy changes that will shape housing demand, pricing, and opportunity in the year ahead.

2025 Market Recap: Stabilization After Volatility

Price Movements: From Surge to Steadiness

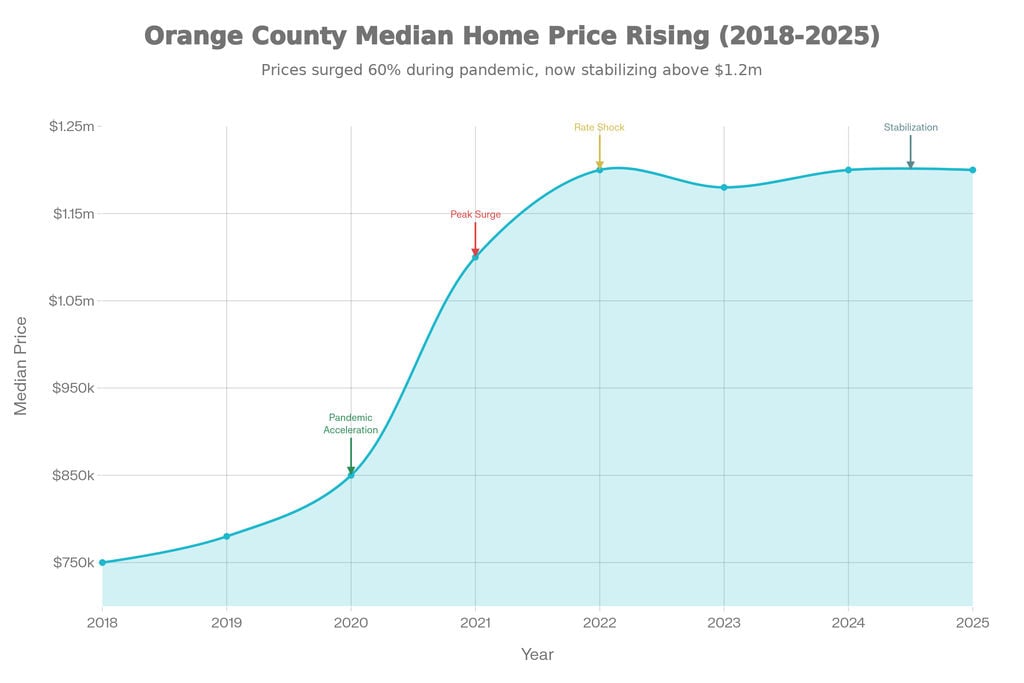

The 2025 housing market in Southern California told a story of stabilization following years of dramatic swings. After the pandemic-era surge that saw double-digit annual appreciation, followed by the sharp rate-induced slowdown of 2022-2023, the market entered a more balanced phase in 2025.

Statewide, California's median home price reached $899,140 by August 2025, representing a modest 1.2% increase year-over-year. This marked a significant deceleration from the 6.8% growth recorded in 2024. Orange County's median held steady in the $1.1 to $1.385 million range throughout most of 2025, with Southern California broadly posting a median of $866,400 in early 2025—up 4.8% from the previous year.

The county experienced notable divergence by property type and location. Detached single-family homes in Orange County commanded a median of $1,376,389 in Q1 2025, reflecting 5.9% year-over-year appreciation. Attached homes, by contrast, softened to a $745,000 median—down 0.7%—as buyers gravitated toward single-family residences in a higher-rate environment. By year's end, the overall county median stabilized around $1.1-1.2 million, essentially flat on an annual basis.

Figure 1: Orange County median home prices rose dramatically during the pandemic (2020-2022) and have plateaued at elevated levels around $1.2M since 2022, showing stabilization rather than meaningful correction

This chart shows the dramatic pandemic-era surge from $750K to $1.2M, followed by stabilization at elevated levels. The market has plateaued rather than corrected, with prices holding steady around $1.2M since 2022.

Inventory and Sales Volume: Signs of Life

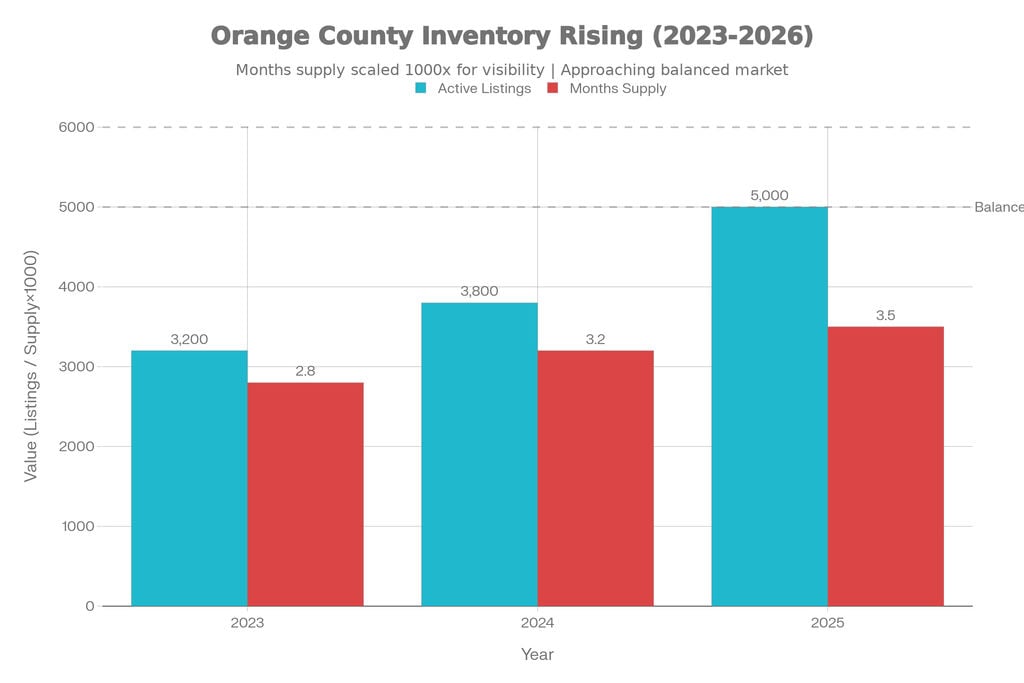

Perhaps the most significant development of 2025 was the gradual thawing of inventory constraints. California's existing single-family home sales reached an annualized rate of 283,540 in February 2025—the strongest monthly pace in more than two years and up 2.6% year-over-year. This sales rebound reflected both slightly improved affordability from rate moderation and pent-up demand finally converting to transactions.

Orange County's active listings increased 48% year-over-year by mid-2025, though this remained dramatically below the 15,000+ listings seen during the Great Recession peak. The Unsold Inventory Index—a measure of months' supply—hovered around 3.5 months, still firmly in seller's market territory (balanced markets typically show 5-6 months supply). Southern California's inventory grew approximately 9% year-over-year in early 2025, providing buyers with incrementally more choice than the constrained conditions of 2022-2023.

Days on market extended as sellers adjusted expectations. Properties that once went pending in 30-40 days now averaged 48-76 days depending on price point and location. This normalization didn't signal market weakness but rather a return to more rational pricing dynamics after years of bidding war frenzy.

Mortgage Rates and Demand Dynamics

Mortgage rates defined much of 2025's market psychology. After peaking above 7% in late 2023, rates stabilized in the mid-6% range throughout 2025, averaging 6.6-6.8% for 30-year fixed-rate mortgages. While elevated by historical standards, this represented relief from the 7%+ environment that had paralyzed market activity.

The persistent "golden handcuff" effect—where existing homeowners with 2-3% mortgages from 2020-2021 remained reluctant to sell—continued suppressing inventory. Yet life events, job relocations, and gradual acceptance of the "new normal" in rates slowly nudged more sellers to list properties. By late 2025, approximately 27% of Orange County homes still sold above list price, demonstrating that well-priced, well-presented properties in desirable locations retained competitive dynamics.

Economic Backdrop: Headwinds Persist

California's broader economy presented mixed signals in 2025. The state's unemployment rate rose to 5.6% by September 2025, reflecting weak job growth and a challenging labor market. While the AI boom continued generating high-paying positions in tech hubs—with average tech salaries in San Francisco reaching $195,000—the gains didn't translate uniformly across California. Orange County's tech sector faced slower projected growth (approximately 1% over five years), making the county more dependent on healthcare, professional services, and small business employment.

Population trends added complexity. California lost approximately 216,000-239,000 residents to domestic outmigration between 2024 and 2025, with middle-income families, retirees, and remote workers seeking more affordable states. However, international immigration rebounded to partially offset these losses, contributing roughly 150,000 new residents, though this remained only half the level seen in 2023-2024 due to federal policy changes. The net result: California's population grew a minuscule 0.05% (approximately 19,200 people), marking three consecutive years of extremely tepid growth after decades of robust expansion.

2026 Forecast: Macro Economic Trends Shaping Housing

Interest Rates and Federal Reserve Policy: The New Reality

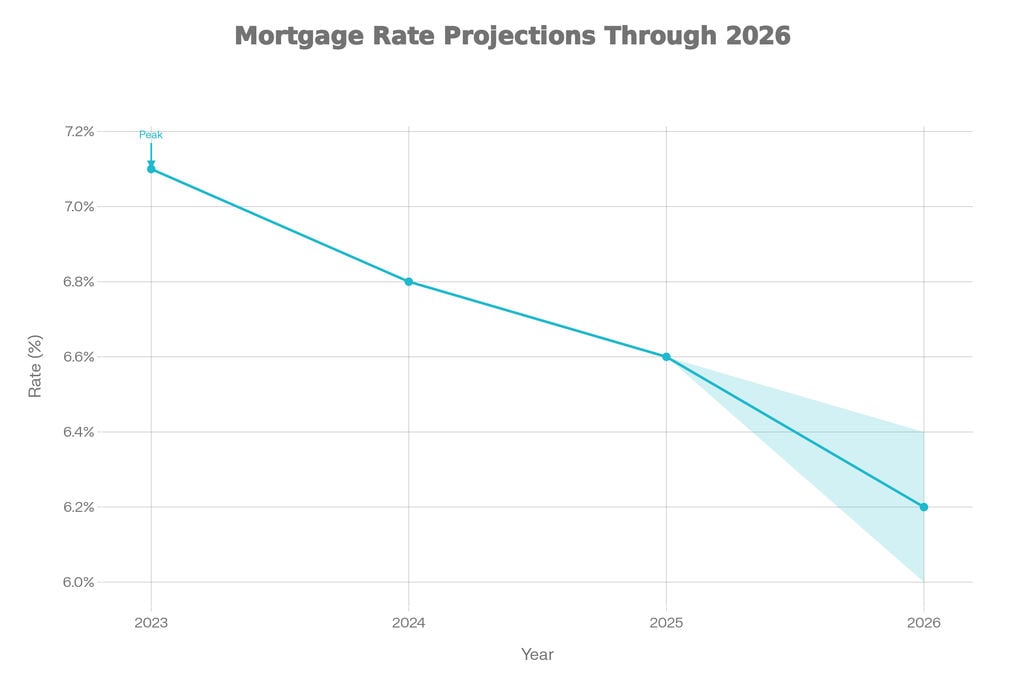

Perhaps no factor will influence Orange County's 2026 housing market more than interest rate trajectory. The consensus among major forecasting institutions points to mortgage rates averaging 5.9%-6.4% throughout 2026—a modest improvement from 2025's 6.6% average but far from the 3-4% rates many prospective buyers continue hoping for.

Redfin projects 30-year fixed rates will average 6.3% in 2026, while the Mortgage Bankers Association forecasts 6.4%. The California Association of Realtors takes a more optimistic view at 6.0%, and the National Association of Home Builders anticipates 6.17%. Fannie Mae's forecast aligns closely with C.A.R. at 6.0%, with gradual easing toward 5.9% in 2027.

These projections reflect Federal Reserve policy that appears increasingly cautious. The Fed reduced its benchmark rate to the 3.5-3.75% range in December 2025, marking three consecutive rate cuts totaling 1.75 percentage points since September 2024. However, policymakers' median projection calls for only one additional quarter-point cut in 2026, signaling an approach to what the Fed views as a neutral policy stance.

The disconnect between Fed rate cuts and mortgage rate movement underscores an important reality: mortgage rates track long-term bond yields and market expectations, not the Fed's overnight rate directly. With inflation persisting above the Fed's 2% target—projected to end 2026 at 2.5-3.0%—and strong economic growth (2.3% GDP forecast for 2026), bond markets are pricing in limited downside for long-term rates.

For Orange County buyers, this means accepting the 6% range as the new normal rather than waiting for a dramatic rate drop that may never materialize. Brief dips below 6% are possible, particularly if economic weakness emerges, but a sustained return to sub-5% rates appears highly unlikely absent a significant recession.

Figure 2: Mortgage rates are projected to gradually improve to 6.0-6.4% in 2026, down from the 7.1% peak in 2023, but unlikely to drop below 6% consistently

Mortgage rates are gradually declining from the 7.1% peak in 2023 to a projected 6.0-6.4% range in 2026. The shaded area shows the forecast uncertainty, but rates are unlikely to drop below 6% consistently.

Economic Drivers: Growth Amid Uncertainty

California's economic outlook for 2026 reflects cautious optimism tempered by structural challenges. The state appears positioned to outperform national averages, driven primarily by the continued artificial intelligence boom and robust business investment in technology infrastructure.

National GDP growth projections for 2026 range from 1.4% (Deloitte's conservative estimate) to 2.3-2.5% (Federal Reserve and more bullish forecasts). California historically tracks slightly ahead of national figures when tech sector strength dominates, suggesting the state could achieve 2-2.5% growth if AI investment momentum sustains.

Employment trends present greater concern. California's unemployment rate is projected to remain elevated at 5.5% throughout 2026 before potentially improving to 4.6% in 2027. The state lost jobs for four consecutive months through September 2025, and UCLA Anderson Forecast predicts unemployment could peak at 6.2% in early 2026 before gradually recovering. Payroll growth is expected to moderate significantly, with California adding only an estimated 62,000 jobs in 2026—a fraction of historical norms.

The tech sector's dynamics create geographic winners and losers within California. The San Francisco Bay Area continues capturing the lion's share of AI-related investment and high-salary job creation. Orange County's tech employment, by contrast, faces slower growth—projected at just 1% over the next five years—due to the county's smaller concentration of major technology firms and ongoing challenges with tech talent retention (only 49% of recent college graduates remain in OC for tech roles).

This employment picture matters enormously for housing demand. While tech professionals earning $150,000-250,000+ can readily afford Orange County's million-dollar price points, the broader base of middle-income workers faces mounting affordability barriers. Healthcare, education, retail, and professional services—sectors providing middle-class employment—cannot compete with tech compensation, creating a two-tier market where high-earning households bid up desirable properties while middle-income families increasingly exit to more affordable states or inland California regions.

Migration Patterns: The California Exodus Continues (But Slows)

California's population dynamics remain one of the most consequential trends for Orange County real estate. The state's domestic outmigration—residents leaving for other states—totaled approximately 216,000-239,000 between 2024 and 2025. This exodus, driven primarily by housing costs, represents the continuation of a multi-year trend where middle-income families, retirees, and remote workers relocate to states like Texas, Arizona, Nevada, and Tennessee.

The profile of those leaving tells the story: families priced out of homeownership, retirees converting California home equity into more comfortable retirements elsewhere, and knowledge workers leveraging remote work flexibility to maintain California salaries while living in lower-cost states. Conversely, those staying and arriving include young professionals pursuing career opportunities, immigrants and international students, and high-earning households for whom California's housing costs remain manageable relative to income.

International immigration, historically a powerful population growth engine for California, rebounded modestly in 2025 but at only half the 2023-2024 level. The Trump administration's termination of most humanitarian migration programs in 2025 significantly curtailed inflows, with net international migration declining to levels not seen in decades. This policy shift—if sustained—removes a critical demand source that historically offset domestic outmigration.

The net result: California's population grew just 0.05% (roughly 19,200 people) between July 2024 and July 2025. Without international immigration and natural increase (births minus deaths), the state would have experienced outright population decline. For Orange County specifically, projections suggest modest growth continuing, with the Southern California Association of Governments estimating the county will reach 3.43 million residents by 2035—up from 3.18 million in 2016—representing average annual growth of only 0.4%.

What does this mean for housing? Slower population growth reduces aggregate demand pressure but doesn't eliminate it. California's chronic housing shortage—decades of underbuilding relative to household formation—means even tepid population growth perpetuates supply-demand imbalances. Orange County added minimal new housing inventory in 2025, and high construction costs combined with regulatory complexity continue constraining new development. The result: existing homes retain value even as population growth slows, because available housing stock remains insufficient for existing residents, let alone new arrivals.

Orange County 2026 Outlook: Neighborhood-Level Insights

Home Price Projections: Modest Appreciation Expected

Orange County's home price trajectory for 2026 points toward modest but positive appreciation after 2025's essentially flat performance. The California Association of Realtors projects statewide median prices will increase 3.6% in 2026, reaching $905,000. Orange County, given its premium positioning and supply constraints, is expected to track closely with or slightly below this statewide figure, suggesting overall county appreciation in the 1-4% range.

This translates to Orange County's median price reaching approximately $1.15-1.25 million by year-end 2026, though significant variation exists across submarkets. Several factors support continued modest appreciation:

Supply remains constrained: Despite 2025's inventory improvement, Orange County's 3.5-4 months of supply remains well below the 5-6 months considered balanced. The golden handcuff effect continues, with homeowners locked into sub-3% mortgages reluctant to trade up into 6%+ rates.

Demand fundamentals persist: Orange County's appeal—top-ranked schools, low crime, proximity to employment centers, coastal access—doesn't diminish simply because rates remain elevated. High-earning households continue viewing the county as aspirational, while international buyers (particularly from Asia) maintain interest in the region's stability and educational infrastructure.

New construction deficit: Limited new residential development means existing home inventory absorbs most buyer demand. Construction costs, land scarcity, and regulatory complexity make new projects pencil only at price points accessible to affluent buyers, providing little relief for middle-market inventory.

Interest rate sensitivity: If mortgage rates drift toward 6% (rather than 6.5%), purchasing power improves meaningfully. A buyer with a $7,000 monthly housing budget can afford approximately $25,000 more home at 6.0% versus 6.8%, potentially reigniting competition for well-priced properties.

The luxury segment—homes above $3 million concentrated in Newport Beach, Corona del Mar, Laguna Beach, and select Irvine villages—demonstrates exceptional resilience. These properties, often purchased by cash buyers or high-net-worth individuals less rate-sensitive, continue seeing bidding wars. Luxury inventory represents 33% of Orange County listings but only 16% of closed transactions, creating an undersupply dynamic that supports premium pricing. This "Newport Effect" spills into adjacent submarkets, with properties under $3 million in areas like Costa Mesa's Upper Birds and Huntington Harbour benefiting from comparatively favorable pricing.

Inventory Expectations: Gradual Thawing Continues

Orange County's inventory picture for 2026 suggests continued gradual improvement without dramatic supply surges. Active listings are projected to increase 10% in 2026, extending the recovery that began in late 2024. This represents the third consecutive year of inventory gains but from a historically depressed baseline.

Several dynamics will shape inventory trends:

Life events trump rate lock: While many homeowners remain hesitant to surrender low-rate mortgages, life circumstances—job relocations, family size changes, divorces, retirements—eventually force moves. As time passes since the 2020-2021 refi boom, more homeowners reach inflection points where staying becomes impractical regardless of rate considerations.

Rate stabilization reduces fear: With rates stabilizing in the 6% range rather than continuing upward, sellers gain confidence that moving won't trigger catastrophic affordability loss. A homeowner with a 2.5% mortgage selling and buying at 6% faces real cost increases, but if they waited and rates rose to 7%, the penalty would be worse. Stabilization removes the fear of mistiming.

New construction trickles: While limited, some new inventory enters select submarkets. Irvine continues developing villages within the Irvine Ranch master plan, adding several hundred homes annually. Huntington Beach faces potential significant supply influx if California Resources Corporation's proposed development of 800 homes on 92 beachfront acres gains approval (decision expected mid-2026), though regulatory hurdles remain substantial.

Builder incentives: Production builders are offering aggressive incentives—rate buydowns, upgrades, closing cost assistance—to move inventory in a more competitive environment. This makes new construction relatively more attractive versus resale homes, pulling some demand toward new builds and indirectly easing pressure on existing home inventory.

Despite these factors, don't expect Orange County's inventory to suddenly flood. Months of supply reaching 4.5-5.0 by late 2026 would represent meaningful improvement but still fall short of truly balanced conditions. The county's structural undersupply—decades of restrictive zoning, limited developable land, and NIMBY opposition to density—means inventory constraints remain endemic even as conditions gradually improve.

Figure 3: Orange County inventory is improving with active listings up 72% from 2023 to projected 2026 levels, but months of supply (4.0) remains below the 5-6 month balanced market threshold, maintaining seller advantage

Inventory has improved significantly—up 72% from 2023 to projected 2026 levels. However, at 4.0 months of supply, the market remains below the 5-6 month "balanced market" threshold, maintaining seller advantage.

Buyer Demand: Affordability Crisis Persists

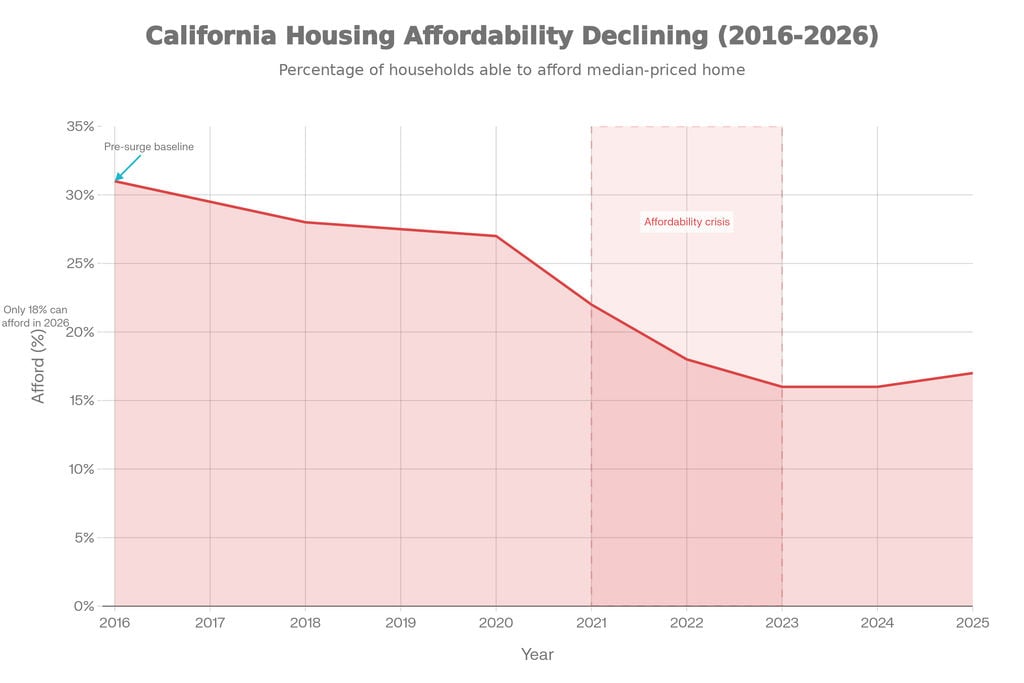

Orange County's affordability crisis shows no signs of meaningful resolution in 2026. The California Association of Realtors projects that only 18% of California households will be able to afford a median-priced home in 2026—a marginal improvement from 16% in 2024 and 17% in 2025 but still catastrophically low by historical standards.

For Orange County specifically, affordability is even worse. With the county's median price sitting 172% above the national average and the regional cost of living 60% above national norms, the income required to purchase a median Orange County home far exceeds what typical households earn. A $1.2 million home requires approximately $156,000-190,000 in annual household income when factoring in 20% down payment, 6.5% mortgage rates, property taxes, HOA fees, and insurance.

Yet demand persists from specific cohorts:

Tech and professional class: High-earning households in technology, finance, healthcare management, and professional services can absorb Orange County's prices. The county attracts significant relocation from Bay Area tech workers seeking more space and better schools at "only" $1.5 million versus San Francisco's $2+ million for comparable properties.

Multi-generational wealth: Families with existing home equity or family assistance (Bank of Mom and Dad) remain active buyers. Generational wealth transfer—Baby Boomers passing assets to Millennials—increasingly funds down payments that would be impossible from earned income alone.

International buyers: Despite immigration policy headwinds, Orange County maintains appeal to Asian buyers (particularly Chinese, Korean, and Taiwanese) seeking U.S. educational access, investment diversification, and political stability. Irvine, with its Asian amenities and university proximity, remains a focal point for international investment.

Lifestyle migrants: High-earning professionals from other states, particularly those exiting high-tax northeastern states or Texas's summer heat, view Orange County as aspirational. Remote work flexibility enables some to maintain out-of-state employers while residing in California, though this trend has decelerated from pandemic peaks.

Current market conditions show 27% of Orange County homes still selling above list price, indicating that well-positioned properties face multiple offers. However, days on market averaging 54 days—significantly longer than the 30-40 days typical in hot markets—suggests buyers are more selective and sellers must price accurately to avoid languishing inventory.

Figure 4: California housing affordability remains near historic lows with only 18% of households projected to afford the median home in 2026, showing modest improvement from the 16% crisis level of 2023-2024 but far below the 31% baseline of 2016

This chart illustrates the affordability crisis: only 18% of California households can afford the median home in 2026, a slight improvement from 16% in 2023-2024 but dramatically worse than the 31% baseline in 2016.

Neighborhood Spotlight: Where Opportunity Exists

Irvine: The Master-Planned Premium

Irvine remains Orange County's most dynamic and closely watched housing market. The city's median price reached $1.52-1.58 million in late 2025, reflecting 1.3% year-over-year appreciation even as broader Orange County stayed flat. For 2026, analysts project Irvine will outperform county averages with 2-4% price growth, potentially pushing the median toward $1.60-1.65 million.

Irvine's resilience stems from multiple reinforcing factors: award-winning Irvine Unified School District (consistently ranked among California's best), exceptionally low crime rates (routinely among the safest cities nationally), master-planned community amenities, proximity to University of California Irvine, and strong employment concentration (particularly biotech and technology). The city's Asian-American population (approximately 45%) creates self-reinforcing demand as families prioritize education and community, with Asian buyers from within California, other states, and internationally seeking Irvine's schools and cultural amenities.

New construction in villages like Eastwood, Orchard Hills, and the developing Great Park Neighborhoods provides inventory that existing neighborhoods can't match. Buyers accept Irvine's premium pricing—often $200-300 per square foot above comparable older Orange County suburbs—because the complete package of schools, safety, amenities, and newness justifies the cost for families prioritizing children's education and long-term stability.

Investment considerations: Irvine represents a "buy and hold forever" market with exceptional long-term stability. While appreciation may be modest in any single year (2-4%), the floor is high—deep corrections are extremely unlikely absent catastrophic California-wide economic collapse. Rental demand remains strong from UCI students, professionals on temporary assignments, and families aspiring to eventually purchase in the city. Vacancy rates typically remain below 5%, supporting consistent rental cash flow for investors willing to accept moderate cap rates (3-4%).

Huntington Beach: Coastal Premium with Complexity

Huntington Beach, Orange County's fourth-largest city and home to nearly 200,000 residents, commands coastal premium pricing with a median around $1.30-1.35 million in late 2025. The city experienced 1.8% appreciation in 2025, and forecasts suggest 2-4% growth in 2026, potentially pushing the median toward $1.35-1.45 million.

The Huntington Beach market bifurcates meaningfully between coastal and inland areas. Properties within a mile of the Pacific—particularly in neighborhoods like Huntington Harbour, Seacliff, and the coastal stretch from Pacific City south—command substantial premiums, often $1.6-2.5+ million for single-family homes. Inland Huntington Beach, particularly east of Beach Boulevard, offers relative "affordability" with homes in the $900,000-1.2 million range, attracting families willing to sacrifice beach proximity for lower pricing and more space.

A major wildcard looms: California Resources Corporation's proposal to redevelop 92 acres of beachfront land into approximately 800 homes, 350 hotel rooms, and 23 acres of parks. If approved (decision expected mid-2026), this represents the largest new housing development Huntington Beach has seen in decades. However, approval faces significant regulatory hurdles including City Council votes, Coastal Commission review, and environmental assessments. If realized, this inventory influx could moderate appreciation in the near term while enhancing the city's long-term appeal through improved amenities and beachfront access.

Investment considerations: Huntington Beach offers stronger appreciation potential than Irvine's steady-eddy approach but with greater volatility risk. Coastal properties within the city demonstrate luxury-like dynamics—affluent buyers purchasing for lifestyle rather than price sensitivity. Rental demand spans seasonal vacation renters, surf-culture locals, and professionals seeking beach proximity. Cap rates typically run 4-5%, reflecting premium coastal pricing with moderate rental yields.

Fullerton: The Affordability Play (Relatively Speaking)

Fullerton represents Orange County's middle-market sweet spot, offering single-family homes in the $1.01-1.1 million range—roughly $300,000-500,000 below Irvine and Huntington Beach. The city experienced slight price softening in 2025 (down 0.4%), reflecting affordability pressures pushing buyers toward lower price points when possible.

For 2026, Fullerton is expected to stabilize with modest appreciation (1-2%), tracking slightly below county averages. While not flashy, Fullerton delivers solid fundamentals: good school options (particularly north Fullerton areas feeding into highly-rated schools), historic downtown charm, abundant parks, and convenient freeway access to Los Angeles and Orange County employment centers. The city attracts first-time buyers stretching to enter Orange County's market, families prioritizing larger homes over coastal proximity, and investors seeking better cash flow than premium coastal markets provide.

Fullerton's housing stock skews older—many homes date from 1960s-1980s tract developments—which presents both challenge and opportunity. Buyers seeking turnkey perfection may prefer Irvine's newer construction, but those willing to renovate or accept dated finishes can find better value. Approximately 35-40% of Fullerton homes sold above list price in 2025, indicating that well-priced, well-presented properties still attract competition despite the city's "affordable" positioning.

Investment considerations: Fullerton offers superior cash flow potential versus premium Orange County markets. Rental demand comes from families who can't afford homeownership, young professionals beginning careers, and California State University Fullerton students and staff. Cap rates can reach 4-5% with proper property selection, meaningfully above the 3-4% typical in coastal areas. Appreciation expectations should be moderate (matching inflation), but the combination of cash flow and gradual appreciation creates solid long-term returns for patient investors.

Coastal vs. Inland: The Diverging Markets

Orange County's coastal and inland markets increasingly diverge in 2026, reflecting affordability stratification and buyer preferences. Coastal cities—Newport Beach, Laguna Beach, Dana Point, and coastal sections of Huntington Beach—serve high-net-worth households for whom price sensitivity is minimal. These markets prioritize lifestyle, views, and exclusivity, with median prices often $1.8-4+ million depending on specific neighborhoods.

Inland markets—Anaheim, Santa Ana, Garden Grove, Tustin, Orange—provide relative accessibility for middle-income buyers and first-timers. Median prices in these cities range $800,000-1.1 million, representing $300,000-700,000 discounts versus coastal areas. These inland cities absorb much of Orange County's working-class and middle-income demand, with appreciation rates typically tracking 1-2 percentage points below coastal premium markets.

The coastal-inland divide also manifests in inventory dynamics. Coastal markets face acute supply constraints—limited developable land, stringent coastal protections, and wealthy homeowners rarely forced to sell. Inland markets have modestly better inventory, particularly in older suburbs where homeowners more frequently relocate for life circumstances. This creates opportunities for savvy buyers willing to trade ocean breezes for financial breathing room and investors seeking better cash-on-cash returns.

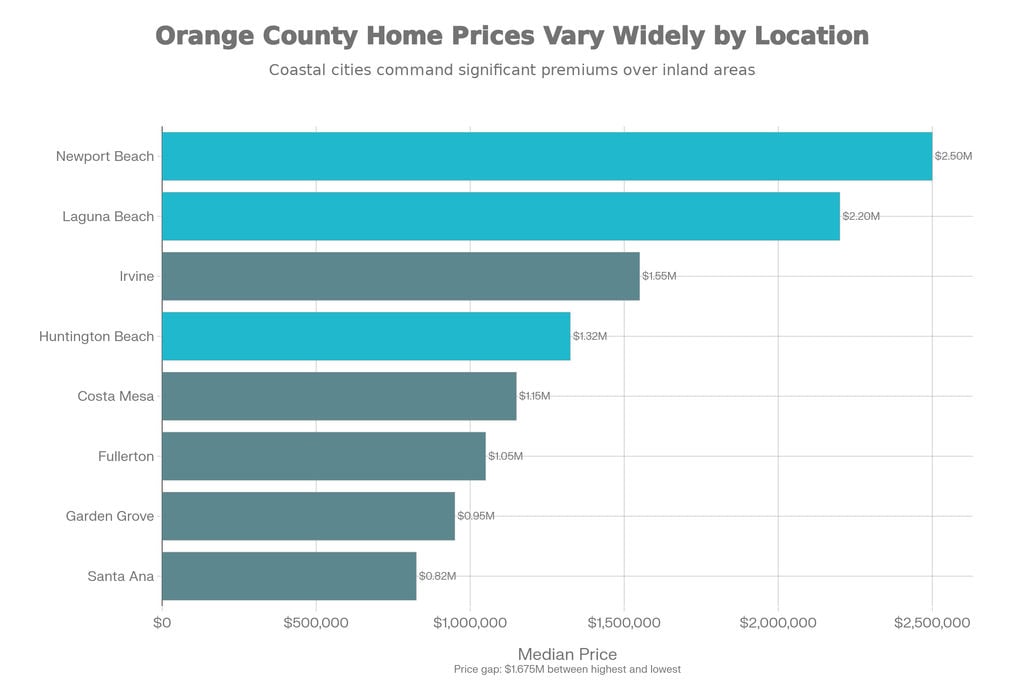

Figure 5: Orange County median home prices vary dramatically by city, with a $1.675M gap between Newport Beach ($2.5M) and Santa Ana ($825K), reflecting coastal premium, school quality, demographics, and lifestyle factors within the same county

The massive price variation across Orange County is clear, with a $1.675M gap between Newport Beach ($2.5M) and Santa Ana ($825K). Coastal cities command substantial premiums, while inland cities offer relative affordability—though "affordable" remains subjective in this market.

Buyer and Seller Strategies for 2026

Buyer Strategies: Navigating Limited Inventory and Elevated Rates

Orange County's 2026 market presents buyers with improved but still challenging conditions. Success requires strategic thinking, financial preparation, and realistic expectations.

Timing Considerations

Early 2026—particularly January through March—may offer a strategic window before spring competition intensifies. Sellers listing during winter months are often motivated by genuine need (job relocations, financial pressures, life changes) rather than speculative selling, creating potential negotiation leverage. Additionally, fewer competing buyers brave winter market conditions, reducing multiple-offer scenarios.

However, don't attempt precise market timing. If rates drift to 5.9% in March versus 6.3% in January, the monthly payment difference on a $1.2 million purchase is approximately $200—meaningful but not transformative. Finding the right property and negotiating effectively matters more than capturing the absolute rate bottom.

Financing Strategies

Accept 6-6.5% mortgage rates as baseline and structure offers accordingly. Strategies to consider:

Rate buydowns: Negotiate seller-paid rate buydowns (temporary or permanent) as part of purchase terms. In slower inventory, sellers may prefer offering $15,000-30,000 toward buydowns rather than reducing list price, as it preserves comp values while making your offer competitive.

ARM consideration: Adjustable-rate mortgages (7/1 or 10/1 ARMs) typically price 0.5-1.0% below 30-year fixed rates. If you plan to relocate, refinance, or pay down principal within 7-10 years, ARMs provide material savings. However, ensure you can afford worst-case rate adjustments if circumstances prevent refinancing.

Larger down payments: Every additional dollar down reduces monthly obligations. If possible, target 25-30% down rather than 20% minimum, both to lower payments and strengthen offer attractiveness to sellers who value financing certainty.

All-cash offers (if feasible): Cash buyers possess extraordinary leverage in 2026. Sellers value certainty and speed, and cash offers eliminate appraisal and financing contingencies that kill deals. Even if you plan to eventually mortgage the property, purchasing cash and refinancing post-close provides maximum negotiation power. This strategy works best for affluent buyers or those willing to tap retirement accounts or investment portfolios for liquidity.

Negotiation Tactics

Buyers have regained modest negotiation leverage compared to 2021-2022's bidding war environment. Effective tactics:

Inspection-based negotiations: Given properties sitting longer on market, thorough inspections often reveal issues sellers must address. Rather than walking away, negotiate credits or repairs. A $20,000 inspection credit on a $1.3 million purchase is material, and sellers facing extended days-on-market may prefer concessions to relisting.

Escalation clauses: In competitive situations, escalation clauses (offering $X above highest competing offer up to ceiling amount) demonstrate seriousness while avoiding overpaying. Structure carefully to avoid incentivizing artificial competing bids.

Close-of-escrow timing flexibility: Offering sellers flexibility—particularly rent-back periods allowing them to remain in home 30-60 days post-close—costs buyers nothing but provides sellers valuable time to secure replacement housing. This psychological factor often sways decisions between similar offers.

Personal letters (used cautiously): While fair housing laws limit discriminatory decision-making, personal letters describing your family and connection to the property can create emotional attachment. Use judiciously and ensure content avoids protected class references (religion, family status, etc.) that could create legal issues.

Property Selection Wisdom

Focus on properties offering long-term value rather than chasing appreciation:

School quality: Even buyers without children should prioritize homes in strong school districts. These properties maintain value better during downturns and attract larger buyer pools during sale.

Original condition with good bones: Dated but structurally sound homes offer opportunity to force appreciation through renovation while entering at lower price points. A $900,000 fixer in good Fullerton neighborhood ultimately delivers better value than a turnkey $1.1 million home in marginal area.

Avoid peak pricing on "hot" features: Homes with trendy upgrades (luxury primary suites, outdoor kitchens, smart home tech) command premiums but depreciate as trends evolve. Classic, timeless features hold value longer.

Walk score and commute patterns: Even if you're remote now, properties with walkable amenities and reasonable commutes retain broader appeal. Avoid homes dependent on single employer proximity (e.g., buying solely for aerospace company access) as employment patterns shift.

Seller Strategies: Positioning for Success

Orange County sellers face a more nuanced market in 2026 than recent years. Success requires strategic pricing, compelling presentation, and realistic expectations.

Pricing Strategy: The Critical Foundation

Pricing accuracy matters more in 2026 than any recent year. With buyers analyzing inventory for weeks rather than hours, overpriced homes languish, accumulate DOM stigma, and ultimately sell for less than if priced correctly initially.

Comparative market analysis depth: Go beyond surface-level comps. Analyze not just recent sales but current listings and expired/withdrawn listings. If homes similar to yours are sitting for 60+ days, price accordingly—not based on what sold three months ago but what sells today.

Price to market conditions, not emotions: Your 2021 Zestimate and neighbor's pandemic-era sale are irrelevant. Today's buyers have options, time to evaluate, and financing costs double what they were in 2021. Price reflects current market reality, not past valuations.

Strategic positioning: Consider pricing just below psychological thresholds ($999,000 versus $1,050,000, or $1,199,000 versus $1,250,000) to capture maximum search traffic. Buyers filter searches by price caps, and appearing in one more price bracket can double showing volume.

Seller concessions as value preservation: If market softness requires some price adjustment, consider structuring as "seller credits toward buyer costs" rather than list price reduction. This maintains published comps while addressing buyer affordability concerns. A $1.3 million list price with $25,000 credit looks better in future appraisals than a $1.275 million list price.

Staging and Presentation: Making Memorable Impressions

2026 staging trends emphasize warmth, authenticity, and lifestyle appeal over sterile minimalism.

Declutter and depersonalize: Remove family photos, excessive personal collections, and niche décor. Buyers should envision their lives, not navigate yours. Rent storage units if necessary to clear space.

Embrace warm minimalism: Replace cold minimalism with "warm minimalism"—neutral palettes with layered textures, natural materials (wood, stone, linen), and curated accessories that suggest lifestyle rather than vacancy. Think boutique hotel lobby rather than sterile doctor's office.

Lighting layers: Maximize natural light by opening blinds and adding supplemental lighting. Layer overhead, table, and floor lamps to create depth and eliminate dark corners. Poor lighting shrinks perceived space and creates unfavorable first impressions.

Kitchen and bathroom focus: These rooms disproportionately influence value perception. If renovation isn't feasible, invest in deep cleaning, fresh caulk, modern hardware, and neutral countertop styling. A $500 investment in bathroom luxury towels, soap dispensers, and staging accessories reads as "$50,000 renovation" to casual buyers.

Outdoor spaces as extensions: Orange County's climate makes outdoor living central to lifestyle appeal. Stage patios with furniture, potted plants, and ambient lighting. Even modest yards should suggest entertaining potential.

Professional photography non-negotiable: 95% of buyers begin home searches online. Professional photography with proper lighting, angles, and editing determines whether they schedule showings. The $300-500 photography investment generates exponentially more showing volume than amateur smartphone photos.

Marketing Strategy: Reaching Qualified Buyers

MLS plus enhanced syndication: Ensure listing syndication to all major platforms (Zillow, Redfin, Realtor.com, etc.). Monitor platform performance analytics—some neighborhoods show stronger buyer traffic on specific platforms.

Video walkthroughs: Short (2-3 minute) video tours allow out-of-area buyers to preview homes before scheduling in-person visits. This especially matters for Orange County's Asian and out-of-state buyer cohorts who may be shopping from distance.

Strategic open house timing: Rather than traditional Sunday-only open houses, consider Thursday evening or Saturday mid-day openings to capture working professionals. Multiple smaller open houses with appointment-required backups create urgency without overwhelming crowds.

Highlight location advantages: Generic descriptions fail in competitive markets. Emphasize walk scores, specific nearby amenities, school test scores, and commute times to major employment centers. Buyers researching Orange County from out-of-state need context that locals take for granted.

Negotiation Approach: Flexibility Within Boundaries

Evaluate offers holistically: Highest price doesn't always mean best offer. Cash offers with flexible closing and no contingencies often justify accepting $20,000-30,000 below highest financed offer to ensure certainty and speed.

Counter constructively: When receiving lowball offers, counter productively rather than dismissing. A buyer offering $1.2M on $1.35M list might genuinely believe comps support that pricing. Counter at $1.3M with justification, opening dialogue rather than ending it.

Seller rent-backs: If you need time to secure replacement housing, negotiate rent-back periods (typically 30-60 days). Most buyers accommodate this when sellers pay fair market rent and provide security deposits.

Repair negotiation strategy: After buyer inspections, expect requests for repairs or credits. Prioritize safety and code compliance issues (roof leaks, electrical problems, mold) but push back on cosmetic preferences. Offering a $5,000 credit for buyer to handle minor repairs themselves often resolves inspection negotiations better than scheduling contractors mid-escrow.

Risks and Uncertainties: What Could Derail the Forecast

Recession Risk: The Elephant in the Room

While the consensus forecast calls for continued economic growth, recession probability remains elevated at 30-42%—significantly above the ~15% baseline risk in healthy economies. Several potential triggers could push the economy into contraction:

Labor market deterioration: If unemployment spikes beyond current projections, consumer spending—which drives 70% of GDP—could collapse. California's unemployment already sits at 5.6%, and further weakening would disproportionately impact middle-income households, reducing housing demand.

AI investment slowdown: Much of California's economic optimism rests on continued AI boom momentum. If AI investment proves overhyped or adoption stalls, the tech sector could face significant retrenchment, eliminating high-paying jobs that underpin Orange County's high-end market.

Tariff escalation: The 2025 tariff environment increased costs across supply chains, contributing to persistent inflation. If trade tensions escalate further in 2026, resulting inflation could force the Fed to maintain or raise rates, crushing housing affordability.

For Orange County real estate, recession would likely mean:

5-10% price corrections in median markets

10-20% corrections in luxury segments (as discretionary purchases defer)

Inventory surge as job losses force distressed sales

Rental market softening as affordability improves relative to ownership

However, Orange County's affluent demographic profile and supply constraints would likely limit downside compared to 2008-2011. The county lacks the speculative overbuilding and loose lending that characterized the Great Recession, and high homeowner equity (most owners have 30-50% equity) reduces foreclosure risk.

Regulatory Changes: California's Housing Policy Evolution

California enacted sweeping housing legislation in 2025 taking effect January 1, 2026, fundamentally reshaping development and permitting processes. Key provisions include:

Aggressive permitting shot clocks: New laws impose strict timelines for housing project approvals, with financial penalties for agencies missing deadlines. This could accelerate development, increasing supply—positive for affordability but potentially reducing appreciation rates.

Streamlined ADU and multi-unit approvals: Regulations facilitating accessory dwelling units and small multi-family projects near transit could meaningfully increase rental housing supply in existing neighborhoods. This particularly impacts single-family zoned areas, potentially affecting neighborhood character and property values.

Affordable housing bond ($10 billion): If voters approve the proposed 2026 affordable housing bond, California would fund 135,000+ affordable units. While addressing social needs, large-scale affordable development in premium submarkets sometimes faces neighborhood opposition and can influence surrounding property values.

Restrictive covenant elimination: New laws expand ability to eliminate deed restrictions preventing housing conversion, potentially unlocking commercial-to-residential conversions. This could increase supply but also alter neighborhood composition.

For Orange County homeowners and investors, these regulatory shifts create both opportunity and risk. Increased supply could moderate appreciation, but streamlined permitting might unlock previously impossible development, creating investment opportunities in redevelopment zones.

Lending Restrictions and Financing Availability

The current mortgage environment reflects relatively normal lending standards—qualified borrowers with good credit, stable income, and adequate down payments face no meaningful barriers to financing. However, several scenarios could tighten credit access:

Bank stress from commercial real estate: Many regional and community banks hold significant commercial real estate exposure. If CRE continues struggling (office buildings facing structural obsolescence, retail disruption persisting), bank failures or capital constraints could reduce residential lending capacity.

Jumbo loan market tightening: Orange County's median prices mean most purchases require jumbo loans (exceeding $806,500 conforming limit in 2026). Jumbo lending depends on portfolio lenders and securities markets. If investors sour on mortgage-backed securities, jumbo rates could spike or availability contract, disproportionately impacting higher-price markets like Orange County.

Down payment assistance program cuts: If economic pressures force state or federal budget cuts, elimination or reduction of down payment assistance programs would remove marginal buyers from the market, reducing demand particularly for entry-level inventory.

Geopolitical and External Shocks

California and Orange County remain exposed to external shocks beyond local control:

Immigration policy: Further restrictions on legal immigration would reduce population growth and housing demand. Orange County benefits meaningfully from Asian immigration and international student enrollment—policy changes curtailing these flows directly impact demand.

Natural disasters: California faces persistent wildfire, earthquake, and now flood risk. Major disasters trigger insurance market disruptions (already challenging in California), potentially making properties uninsurable or prohibitively expensive to insure. The January 2025 Palisades and Eaton fires in Los Angeles County demonstrated how quickly disasters reshape local markets.

National housing policy shifts: Federal administration changes could alter mortgage interest deductibility, capital gains exemptions on primary residences, or GSE (Fannie Mae/Freddie Mac) operations. Any of these would ripple through housing markets, particularly in high-price states like California.

Interest rate volatility: While the forecast projects gradual rate declines, unexpected inflation resurgence or financial market stress could spike rates. If 30-year mortgages jumped to 7.5-8%, Orange County's already constrained affordability would deteriorate catastrophically.

Conclusion: Navigating Orange County's 2026 Market

Orange County's 2026 real estate market presents a nuanced landscape of modest opportunity, persistent challenge, and evolving dynamics. After years of pandemic surge, rate shock, and dramatic volatility, the county appears to be settling into a more predictable—if affordability-constrained—equilibrium.

Key Takeaways for Buyers

Act when ready, don't time perfection: Waiting for 4% mortgage rates or dramatic price corrections will likely mean waiting indefinitely. If you can afford the 6-6.5% rate environment, have stable employment, and plan multi-year ownership, 2026 offers reasonable conditions. Properties remain expensive, but inventory improvement and modest seller concessions create negotiation opportunities absent during 2021-2022's frenzy.

Focus on fundamentals over speculation: Buy in strong school districts, established neighborhoods, and locations with employment proximity. These attributes ensure properties retain value through market cycles and attract broad buyer pools when you eventually sell.

Financial preparation matters most: Strong pre-approval, significant down payment (25-30% if possible), and mortgage rate education position you competitively. In marginal multiple-offer situations, financial strength often trumps modestly higher offers.

Consider life stage and goals: If you're establishing roots, raising family, or securing long-term housing stability, Orange County's premium positioning offers exceptional quality of life despite high costs. If you're primarily seeking appreciation returns or short-term residence, other markets may offer better value propositions.

Key Takeaways for Sellers

Price aggressively from day one: The market punishes overpricing more severely than underpricing in 2026. Properties priced to market generate immediate activity, multiple offers, and stronger final prices than overpriced listings that sit, get stale, and eventually sell below initial reasonable pricing.

Presentation drives value perception: Invest in staging, professional photography, and property preparation. These costs (typically $2,000-5,000 total) often generate $20,000-50,000+ in additional sale proceeds through faster sales at stronger prices.

Flexibility on terms wins deals: Accommodating buyer financing, inspection, and timing needs—when reasonable—often determines which offer you accept and whether escrow closes smoothly. Rigid sellers in 2026 face longer marketing times and more transaction failures.

Market timing less critical than circumstances: If your life circumstances require moving, list the property and price it correctly. Attempting to time markets perfectly often backfires—life doesn't pause for optimal market windows, and delaying necessary moves creates its own costs.

Outlook Summary

Orange County's 2026 forecast suggests modest home price appreciation (1-4%), gradually improving inventory (though remaining seller-friendly), stable mortgage rates (6-6.4%), and persistent affordability challenges limiting buyer pools. The luxury segment will likely outperform median markets, coastal areas will maintain premiums over inland submarkets, and school-quality neighborhoods will command increasing premiums as families prioritize children's education.

Recession risks remain present but not imminent. If the economy maintains moderate growth, Orange County's structural supply shortage and affluent demographic profile should support gradual appreciation. A recession would likely trigger 5-10% corrections but not catastrophic declines absent systemic financial crisis.

The fundamental reality: Orange County remains one of California's premier markets, delivering exceptional lifestyle, strong schools, economic opportunity, and long-term stability. These attributes don't change because mortgage rates sit at 6% rather than 3%. For those who can afford entry, the county continues offering compelling quality of life, even if "affordable" ceased describing its housing market decades ago.

Whether buying, selling, or simply tracking your home's value, 2026 requires informed strategy, realistic expectations, and focus on long-term fundamentals over short-term speculation. The market rewards preparation, patience, and pragmatism—qualities that transcend any single year's forecast.